Home » Financial Planning for Retirement

Financial Planning for Retirement

November 1, 2017

From The Carlat Psychiatry Report

Colin Wiens, CFP, MBA

Senior Financial Advisor, Larson Financial Group, LLC.

Registered Representative, Larson Financial Securities, LLC.

Mr. Wiens discloses that he receives various forms of compensation for financial advising services. Dr. Carlat has reviewed this article and has found no evidence of bias in this educational activity.

Colin Wiens, CFP, MBA

Senior Financial Advisor, Larson Financial Group, LLC.

Registered Representative, Larson Financial Securities, LLC.

Mr. Wiens discloses that he receives various forms of compensation for financial advising services. Dr. Carlat has reviewed this article and has found no evidence of bias in this educational activity.

TCPR: How is financial advising different for medical professionals?

Wiens: Because of the lengthy period of training, doctors begin their first “real” jobs 8–10 years after many of their friends from college. And, depending on specialty, burnout may cause a physician to retire a few years earlier than the average American. Both these factors lead to a compressed retirement saving timeline.

TCPR: How much money should we be saving for retirement?

Wiens: First, determine what sort of lifestyle you’d like in retirement. Then quantify your living expenses, based on your retirement activities and lifestyle goals. Generally, physicians aim to replace 40%–60% of their pre-retirement income once in retirement. For example, if you earned $250,000 per year before taxes in your clinical practice, you may want to build enough in Social Security, retirement accounts, passive income, etc, to provide $100,000–$150,000 of after-tax income in the future. In my experience, once the goals are set and quantified, the average physician needs to save 20%–30% of gross annual income for retirement, beginning at completion of residency or fellowship and continuing until the physician’s late 50s or early 60s.

TCPR: Let’s address growing what we save. What’s the difference among the savings vehicles: IRAs, SEP IRAs, Roth IRAs, 401(k)s, etc?

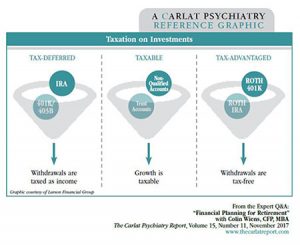

Wiens: All of the items you mentioned are different types of retirement accounts. To help differentiate among them, I often think about the way they are taxed. First, let’s categorize the different types of accounts:

Also, see the diagram below.

TCPR: How do the tax-deferred accounts save money?

Wiens: Let’s assume that you have $18,000 that you’d like to put toward retirement and you’re in the 33% tax bracket.

TCPR: How much can you contribute to a 401(k)?

Wiens: An employee can contribute $18,000 per year, plus a $6,000 catch-up amount for those 50 and older. But in addition to that, companies can match your 401(k) contribution. The amount of the match varies and is determined by the employer. The neat thing about running your own practice is that you are your own employer and you can set your own match. Many of my self-employed physician clients are able to contribute a total of $54,000 (the 2017 IRS limit) between the employee and employer, plus an additional $6,000 catch-up for those 50 and older.

TCPR: What are the advantages of a 401(k) over a SEP IRA?

Wiens: I see three advantages for self-employed doctors to use a 401(k) over a SEP IRA:

Depending on income and what legal/tax entity the practice is (eg, LLC, sole proprietorship, S corporation, etc), a doctor may be able to contribute more to a 401(k) than a SEP IRA. For example, a 52-year-old self-employed psychiatrist with no employees netting $200,000 a year can put about $38,000 into a SEP IRA. Using a 401(k), that same doctor could contribute $60,000. You can run your own numbers using Vanguard’s online contribution calculator (https://personal.vanguard.com/us/SbsCalculatorController).

Secondly, you can borrow from a 401(k) should you ever need a low-interest loan. The interest you pay on the loan goes back into your own 401(k). Please note a 401(k) loan should typically only be used for short-term needs, and I recommend paying these loans back promptly.

Lastly, a 401(k) enables you to use a tool we call the “backdoor Roth IRA” that can’t be used with a SEP IRA.

TCPR: What’s a “backdoor Roth IRA?” I thought most doctors made too much to use a Roth IRA.

Wiens: That’s right—in 2017, if a married physician files taxes jointly and has an income of more than $196,000, that physician can’t contribute to a Roth IRA directly. That’s unfortunate, because Roth IRAs can be powerful tools—the contributions are funded after-tax, but when you withdraw funds in retirement, you pay no taxes on the distributions. The strategy for high-income individuals to fund a Roth IRA is often referred to as the “backdoor Roth IRA” (see https://www.bogleheads.org/wiki/Backdoor_Roth_IRA). Here are the steps:

There are some things that could cause hiccups (an existing balance in a pre-tax IRA or SEP IRA, for example), so I recommend that physicians seek the advice of a qualified accountant to ensure they are implementing the strategy appropriately. However, if used properly, the tax savings can be significant.

TCPR: I’ve heard about Roth 401(k)s; do these have the same income limits?

Wiens: Roth 401(k)s are like a Roth IRA inside of your 401(k), and luckily, they have no income limits. Additionally, they have the same contribution limits as a traditional 401(k): $18,000 per employee, with a $6,000 catch-up for those over 50.

TCPR: Can you fund both a Roth 401(k) and a traditional 401(k)?

Wiens: Yes, but the total contribution between both accounts can’t be higher than the $18,000 with $6,000 catch-up limit.

TCPR: And when can you start taking money out of these retirement accounts?

Wiens: Generally speaking, you can withdraw from qualified retirement plans without a penalty starting at age 59 ½.

TCPR: So if you’re still making a high income and therefore are at a high tax bracket when you’re 60 or 65, you can take Roth IRA money out and you won’t pay any taxes on the investment income it has generated?

Wiens: Yes, that’s correct. And there’s another possible benefit to a Roth IRA. It could be that in 20 years tax policies will have changed and the overall federal or state tax rates are higher. Perhaps you were planning to be in a 25% bracket at retirement, but tax changes have increased your bracket to 35%. In that case, you’d be thankful you had the foresight to invest some of your money into a Roth IRA or Roth 401(k).

TCPR: So deciding on whether to use a tax-deferred 401(k) or a Roth 401(k) is a little complicated. You’re saying that it might be good to invest some money in both, because if you do, you will have more flexibility at retirement. That way, if you are indeed at a lower tax bracket, you could start withdrawing from a tax-deferred 401(k) or a SEP IRA; but if your tax bracket is higher, you can choose to withdraw money from your Roth bucket.

Wiens: Yes, you can strategize when you take money out of each bucket. And one of those buckets isn’t necessarily better than the other bucket. Having money in both of those buckets lets you strategically influence your own tax rate in retirement.

TCPR: Many of us in psychiatry like to continue to work, at least part time, for many years, and we may not feel the need to withdraw from retirement accounts for a while. When are we required to start withdrawing?

Wiens: For the tax-deferred investments like 401(k)s and SEP IRAs, you are required to start withdrawing funds at age 70 ½ due to a rule called Required Minimum Distributions (RMDs). RMDs are the government’s way of basically saying, “Look, you’ve never paid income taxes on the contributions, and we’ve never made money on the growth of this money, and you’re going to die sometime soon, so we want our taxes now.”

TCPR: I see. What’s the last type of investment?

Wiens: The last type is a normal taxable investment account. You contribute to a brokerage account with after-tax money, and if it grows each year and pays dividends, you have to pay taxes on that. Also, if you sell it at a gain, you have to pay capital gains taxes. You typically pay more taxes on those accounts, and they are generally not as well protected as qualified retirement accounts. Accordingly, we encourage most physicians to focus on contributing more into the tax-deferred and tax-advantaged buckets.

TCPR: In your experience working with physicians, do you find a pattern of how they choose to invest their money in the scheme of three buckets?

Wiens: I see many physicians invest almost entirely in tax-deferred accounts because of the general consensus that you are in the highest tax bracket you will ever be in, and in retirement you’ll be in a lower tax bracket. But that’s not necessarily going to be true. One reason for this myopia is that most accountants are very focused on increasing tax deductions. Putting money in a 401(k) saves taxes now, and we often judge how our accountants perform based on how much tax they can save us today. Conversely, if you contribute to a Roth IRA or 401(k), it saves you nothing today, but it may save you money 20 years down the road. As a result, many physicians are missing out on those tax-advantaged plans.

TCPR: I’d like to shift to the question of how we should get advice for investing. In the past, there was an expectation that if you made a decent income and saved a lot of money, you would hire a money manager to invest your money. A money manager would charge an up-front sales charge and/or an annual fee of around 1%–2% of your assets, and you would hope to outperform the market. Lately, that’s shifted: we hear that “index funds” actually outperform money managers, and there are now cheaper ways of getting advice.

Wiens: There are generally two philosophies to investing: active investing and passive investing. Here’s how they break down:

Which is better? As it turns out, over the last few decades, the research and academic data show the passive philosophy beating the active philosophy, especially when portfolios are properly monitored and rebalanced to stay in line with an individual investor’s risk tolerance and time horizon. But it’s still a hot debate. According to the financial analysis firm Morningstar, one strong indicator of future performance is a fund’s expense ratio, or annual cost (http://beta.morningstar.com/articles/752485/fund-fees-predict-future-success-or-failure.html). Index funds tend to have much lower internal expense ratios, which allows more of the investor’s funds to work in the market. Accordingly, paying attention to the investment’s costs is worthwhile.

TCPR: But we still need advice on which index funds to invest in.

Wiens: Yes, and for that, having a financial advisor may make sense. For example, a passive investment advisor may talk to you about the mix of index funds that’s best for your situation and risk level. The advisor may also counsel you on the appropriate tax buckets to use to reduce your tax liability today and in the future.

TCPR: That makes sense. So how do we go about choosing a financial advisor?

Wiens: Begin by understanding how advisors get paid:

TCPR: Thank you for your time.

General PsychiatryWiens: Because of the lengthy period of training, doctors begin their first “real” jobs 8–10 years after many of their friends from college. And, depending on specialty, burnout may cause a physician to retire a few years earlier than the average American. Both these factors lead to a compressed retirement saving timeline.

TCPR: How much money should we be saving for retirement?

Wiens: First, determine what sort of lifestyle you’d like in retirement. Then quantify your living expenses, based on your retirement activities and lifestyle goals. Generally, physicians aim to replace 40%–60% of their pre-retirement income once in retirement. For example, if you earned $250,000 per year before taxes in your clinical practice, you may want to build enough in Social Security, retirement accounts, passive income, etc, to provide $100,000–$150,000 of after-tax income in the future. In my experience, once the goals are set and quantified, the average physician needs to save 20%–30% of gross annual income for retirement, beginning at completion of residency or fellowship and continuing until the physician’s late 50s or early 60s.

TCPR: Let’s address growing what we save. What’s the difference among the savings vehicles: IRAs, SEP IRAs, Roth IRAs, 401(k)s, etc?

Wiens: All of the items you mentioned are different types of retirement accounts. To help differentiate among them, I often think about the way they are taxed. First, let’s categorize the different types of accounts:

- Tax-deferred: often referred to as “tax-sheltered,” these are the retirement accounts we traditionally think of, including 401(k), 403(b), SEP IRA, traditional IRA, pension plan, and 457(b)

- Taxable savings: savings accounts, brokerage accounts, and other “trading” accounts

- Tax-advantaged: Roth IRA, Roth 401(k), Roth 403(b), 529 plans when used for qualified college expenses

Also, see the diagram below.

Graphic: Taxation on Investments

(Click to view full size PDF.)

TCPR: How do the tax-deferred accounts save money?

Wiens: Let’s assume that you have $18,000 that you’d like to put toward retirement and you’re in the 33% tax bracket.

- If you contributed the $18,000 to a 401(k), which is tax-deferred, you wouldn’t pay income taxes on the $18,000 (saving you $5,940).

- Then let’s assume your investment returned a 5% dividend ($900 in income). If you held this in a taxable account, you’d have to pay dividend tax on it. But since it’s in the 401(k), you won’t pay any taxes until you take the money out in retirement, when you may be in a lower tax bracket than you are today. If the $900 was taxed as ordinary dividends, the 401(k) would save you an additional $297 in income tax today. Since you don’t pay tax on that income, you have more principal to grow next year—this compounds growth faster than in a taxable investment account.

TCPR: How much can you contribute to a 401(k)?

Wiens: An employee can contribute $18,000 per year, plus a $6,000 catch-up amount for those 50 and older. But in addition to that, companies can match your 401(k) contribution. The amount of the match varies and is determined by the employer. The neat thing about running your own practice is that you are your own employer and you can set your own match. Many of my self-employed physician clients are able to contribute a total of $54,000 (the 2017 IRS limit) between the employee and employer, plus an additional $6,000 catch-up for those 50 and older.

TCPR: What are the advantages of a 401(k) over a SEP IRA?

Wiens: I see three advantages for self-employed doctors to use a 401(k) over a SEP IRA:

Depending on income and what legal/tax entity the practice is (eg, LLC, sole proprietorship, S corporation, etc), a doctor may be able to contribute more to a 401(k) than a SEP IRA. For example, a 52-year-old self-employed psychiatrist with no employees netting $200,000 a year can put about $38,000 into a SEP IRA. Using a 401(k), that same doctor could contribute $60,000. You can run your own numbers using Vanguard’s online contribution calculator (https://personal.vanguard.com/us/SbsCalculatorController).

Secondly, you can borrow from a 401(k) should you ever need a low-interest loan. The interest you pay on the loan goes back into your own 401(k). Please note a 401(k) loan should typically only be used for short-term needs, and I recommend paying these loans back promptly.

Lastly, a 401(k) enables you to use a tool we call the “backdoor Roth IRA” that can’t be used with a SEP IRA.

TCPR: What’s a “backdoor Roth IRA?” I thought most doctors made too much to use a Roth IRA.

Wiens: That’s right—in 2017, if a married physician files taxes jointly and has an income of more than $196,000, that physician can’t contribute to a Roth IRA directly. That’s unfortunate, because Roth IRAs can be powerful tools—the contributions are funded after-tax, but when you withdraw funds in retirement, you pay no taxes on the distributions. The strategy for high-income individuals to fund a Roth IRA is often referred to as the “backdoor Roth IRA” (see https://www.bogleheads.org/wiki/Backdoor_Roth_IRA). Here are the steps:

- An individual contributes to a non-deductible IRA, as there are no income limitations on these contributions.

- The individual then converts the non-deductible IRA into a Roth IRA. Voila, Roth IRA funded through a backdoor.

There are some things that could cause hiccups (an existing balance in a pre-tax IRA or SEP IRA, for example), so I recommend that physicians seek the advice of a qualified accountant to ensure they are implementing the strategy appropriately. However, if used properly, the tax savings can be significant.

TCPR: I’ve heard about Roth 401(k)s; do these have the same income limits?

Wiens: Roth 401(k)s are like a Roth IRA inside of your 401(k), and luckily, they have no income limits. Additionally, they have the same contribution limits as a traditional 401(k): $18,000 per employee, with a $6,000 catch-up for those over 50.

TCPR: Can you fund both a Roth 401(k) and a traditional 401(k)?

Wiens: Yes, but the total contribution between both accounts can’t be higher than the $18,000 with $6,000 catch-up limit.

TCPR: And when can you start taking money out of these retirement accounts?

Wiens: Generally speaking, you can withdraw from qualified retirement plans without a penalty starting at age 59 ½.

TCPR: So if you’re still making a high income and therefore are at a high tax bracket when you’re 60 or 65, you can take Roth IRA money out and you won’t pay any taxes on the investment income it has generated?

Wiens: Yes, that’s correct. And there’s another possible benefit to a Roth IRA. It could be that in 20 years tax policies will have changed and the overall federal or state tax rates are higher. Perhaps you were planning to be in a 25% bracket at retirement, but tax changes have increased your bracket to 35%. In that case, you’d be thankful you had the foresight to invest some of your money into a Roth IRA or Roth 401(k).

TCPR: So deciding on whether to use a tax-deferred 401(k) or a Roth 401(k) is a little complicated. You’re saying that it might be good to invest some money in both, because if you do, you will have more flexibility at retirement. That way, if you are indeed at a lower tax bracket, you could start withdrawing from a tax-deferred 401(k) or a SEP IRA; but if your tax bracket is higher, you can choose to withdraw money from your Roth bucket.

Wiens: Yes, you can strategize when you take money out of each bucket. And one of those buckets isn’t necessarily better than the other bucket. Having money in both of those buckets lets you strategically influence your own tax rate in retirement.

TCPR: Many of us in psychiatry like to continue to work, at least part time, for many years, and we may not feel the need to withdraw from retirement accounts for a while. When are we required to start withdrawing?

Wiens: For the tax-deferred investments like 401(k)s and SEP IRAs, you are required to start withdrawing funds at age 70 ½ due to a rule called Required Minimum Distributions (RMDs). RMDs are the government’s way of basically saying, “Look, you’ve never paid income taxes on the contributions, and we’ve never made money on the growth of this money, and you’re going to die sometime soon, so we want our taxes now.”

TCPR: I see. What’s the last type of investment?

Wiens: The last type is a normal taxable investment account. You contribute to a brokerage account with after-tax money, and if it grows each year and pays dividends, you have to pay taxes on that. Also, if you sell it at a gain, you have to pay capital gains taxes. You typically pay more taxes on those accounts, and they are generally not as well protected as qualified retirement accounts. Accordingly, we encourage most physicians to focus on contributing more into the tax-deferred and tax-advantaged buckets.

TCPR: In your experience working with physicians, do you find a pattern of how they choose to invest their money in the scheme of three buckets?

Wiens: I see many physicians invest almost entirely in tax-deferred accounts because of the general consensus that you are in the highest tax bracket you will ever be in, and in retirement you’ll be in a lower tax bracket. But that’s not necessarily going to be true. One reason for this myopia is that most accountants are very focused on increasing tax deductions. Putting money in a 401(k) saves taxes now, and we often judge how our accountants perform based on how much tax they can save us today. Conversely, if you contribute to a Roth IRA or 401(k), it saves you nothing today, but it may save you money 20 years down the road. As a result, many physicians are missing out on those tax-advantaged plans.

TCPR: I’d like to shift to the question of how we should get advice for investing. In the past, there was an expectation that if you made a decent income and saved a lot of money, you would hire a money manager to invest your money. A money manager would charge an up-front sales charge and/or an annual fee of around 1%–2% of your assets, and you would hope to outperform the market. Lately, that’s shifted: we hear that “index funds” actually outperform money managers, and there are now cheaper ways of getting advice.

Wiens: There are generally two philosophies to investing: active investing and passive investing. Here’s how they break down:

- Active investing is when a money manager says, “I have experience and insight into the market, and I’ll use that special knowledge to choose the right investments to achieve growth and profit. If you want to benefit from this, I’ll charge you a fee for my expertise.”

- Passive investing says that no one can consistently predict or outperform the market in a way that is statistically relevant or even better than a coin flip. So, instead of trying to beat the market, passive investing uses index funds or broadly diversified funds. An index fund is a collection of stocks that track a particular index. For example, the S&P 500 (Standard and Poor 500) tracks 500 large U.S. publicly traded companies. There are many other index funds tracking different-sized companies and different parts of the world, such as small companies, emerging markets, and other foreign company indices.

Which is better? As it turns out, over the last few decades, the research and academic data show the passive philosophy beating the active philosophy, especially when portfolios are properly monitored and rebalanced to stay in line with an individual investor’s risk tolerance and time horizon. But it’s still a hot debate. According to the financial analysis firm Morningstar, one strong indicator of future performance is a fund’s expense ratio, or annual cost (http://beta.morningstar.com/articles/752485/fund-fees-predict-future-success-or-failure.html). Index funds tend to have much lower internal expense ratios, which allows more of the investor’s funds to work in the market. Accordingly, paying attention to the investment’s costs is worthwhile.

TCPR: But we still need advice on which index funds to invest in.

Wiens: Yes, and for that, having a financial advisor may make sense. For example, a passive investment advisor may talk to you about the mix of index funds that’s best for your situation and risk level. The advisor may also counsel you on the appropriate tax buckets to use to reduce your tax liability today and in the future.

TCPR: That makes sense. So how do we go about choosing a financial advisor?

Wiens: Begin by understanding how advisors get paid:

- Advisors may receive a commission selling a particular product, like an active mutual fund.

- Advisors who work for insurance companies may receive a commission for advising you to buy an insurance-based product.

- Finally, there are fee-for-service advisors, who get paid by you to give advice and/or manage your investments.

TCPR: Thank you for your time.

KEYWORDS practice-tools-and-tips

Issue Date: November 1, 2017

Table Of Contents

Recommended

Newsletters

Please see our Terms and Conditions, Privacy Policy, Subscription Agreement, Use of Cookies, and Hardware/Software Requirements to view our website.

© 2026 Carlat Publishing, LLC and Affiliates, All Rights Reserved.

_-The-Breakthrough-Antipsychotic-That-Could-Change-Everything.webp?t=1729528747)